how to lower property taxes in maryland

The countys average effective property tax rate is 130 while the average rate statewide is 137. If you have questions about how property taxes can affect your overall financial plans a financial advisor in Wichita can help you out.

How To Find Tax Delinquent Properties In Your Area Rethority

These vary by county.

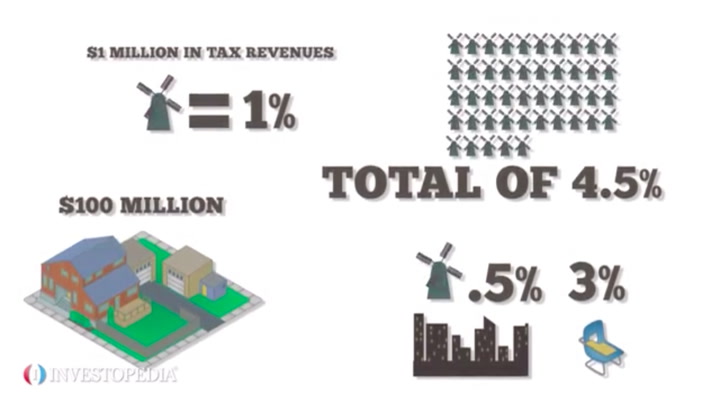

. Property tax rates in Georgia can be described in mills which are equal to 1 of taxes for every 1000 in assessed value. Property taxes are the largest source of revenue for Wyandotte County. The statewide exemption is 2000 but it applies only to the statewide property tax which is a relatively small slice of the overall property taxes in most areas.

Georgia Property Tax Rates.

Real Property Tax Howard County

How To Lower Your Property Taxes Youtube

Property Taxes How Much Are They In Different States Across The Us

Who Pays The Highest Property Taxes Property Tax Denver Real Estate Real Estate Tips

Probate Vs Non Probate Assets In Ohio Our Deer Probate Ohio Estate Tax

Property Tax Prorations Case Escrow

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Pin By Cutmytaxes On Property Tax Appeal In 2021 Property Tax Hb2 Symbols

Florida Property Tax H R Block

Pin By Cutmytaxes On Property Tax Appeal In 2021 Property Tax Tax Property

Deducting Property Taxes H R Block

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Pin By Cutmytaxes On Property Tax Appeal In 2021 Property Tax Hb2 Symbols

Soaring Home Values Mean Higher Property Taxes

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)