what is fsa/hra eligible health care expenses

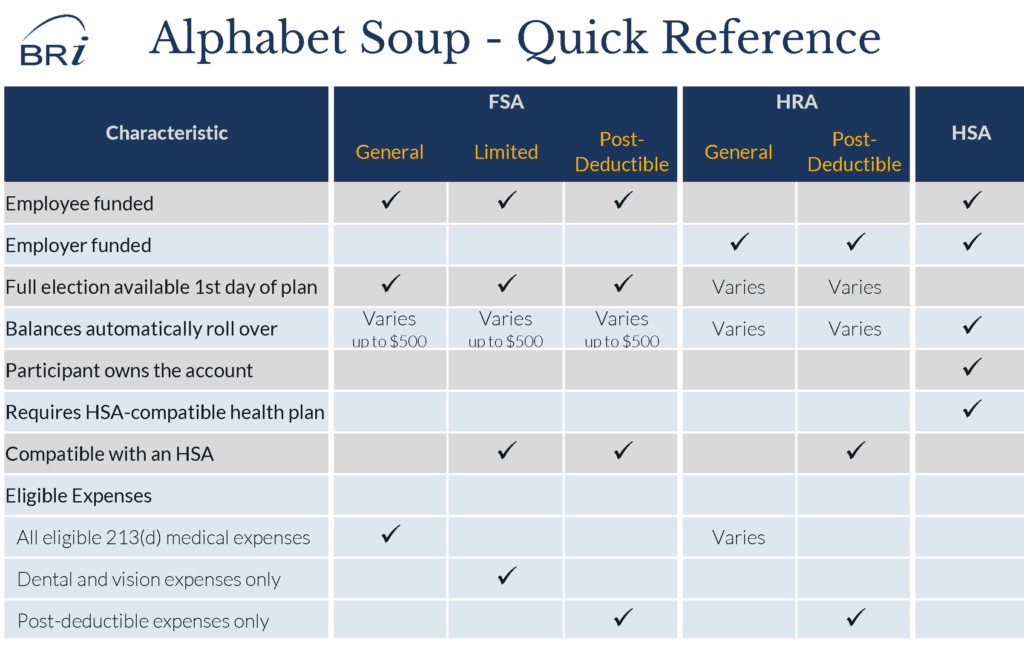

There are three kinds of FSAs that may be available if you choose your own individual and family plan or one through your employer. Heres how a health and medical expense FSA works.

Health Care And Dependent Care Fsas Infographic Optum Financial

Dependent Care FSAs are sanctioned under Section 129 of the IRS Code.

. Ad Shop The Largest Selection Of FSA-Eligible Products Today And Get Free Shipping 50. That the expense is primarily for medical care a note from a medical practitioner recommending the item to treat a specific condition is normally required. It covers medical dental vision and pharmacy expenses.

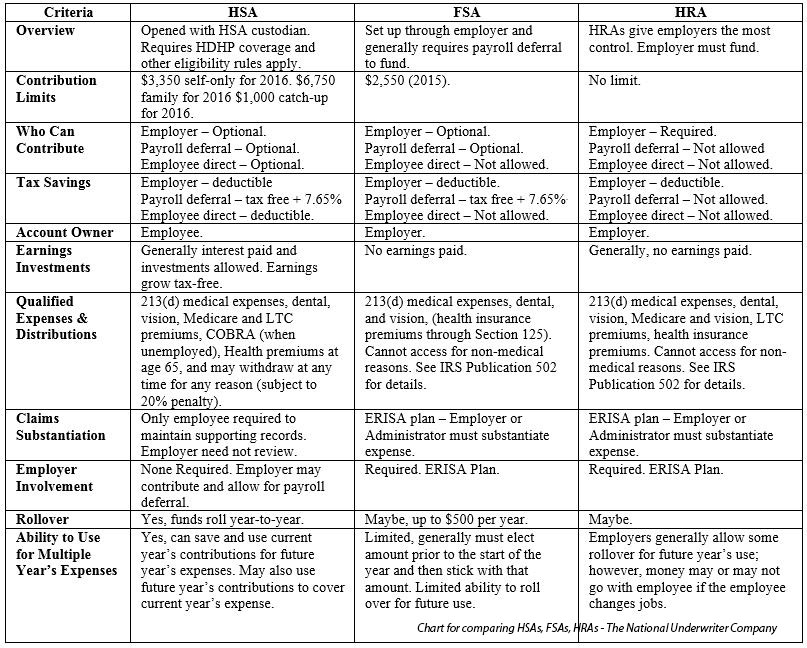

Every dollar that you contribute to an HSA can pay for eligible medical expenses. You may use HSA FSA or HRA funds to pay for these products. The types of FSAs differ based on what health care expenses you can use your FSA funds to cover.

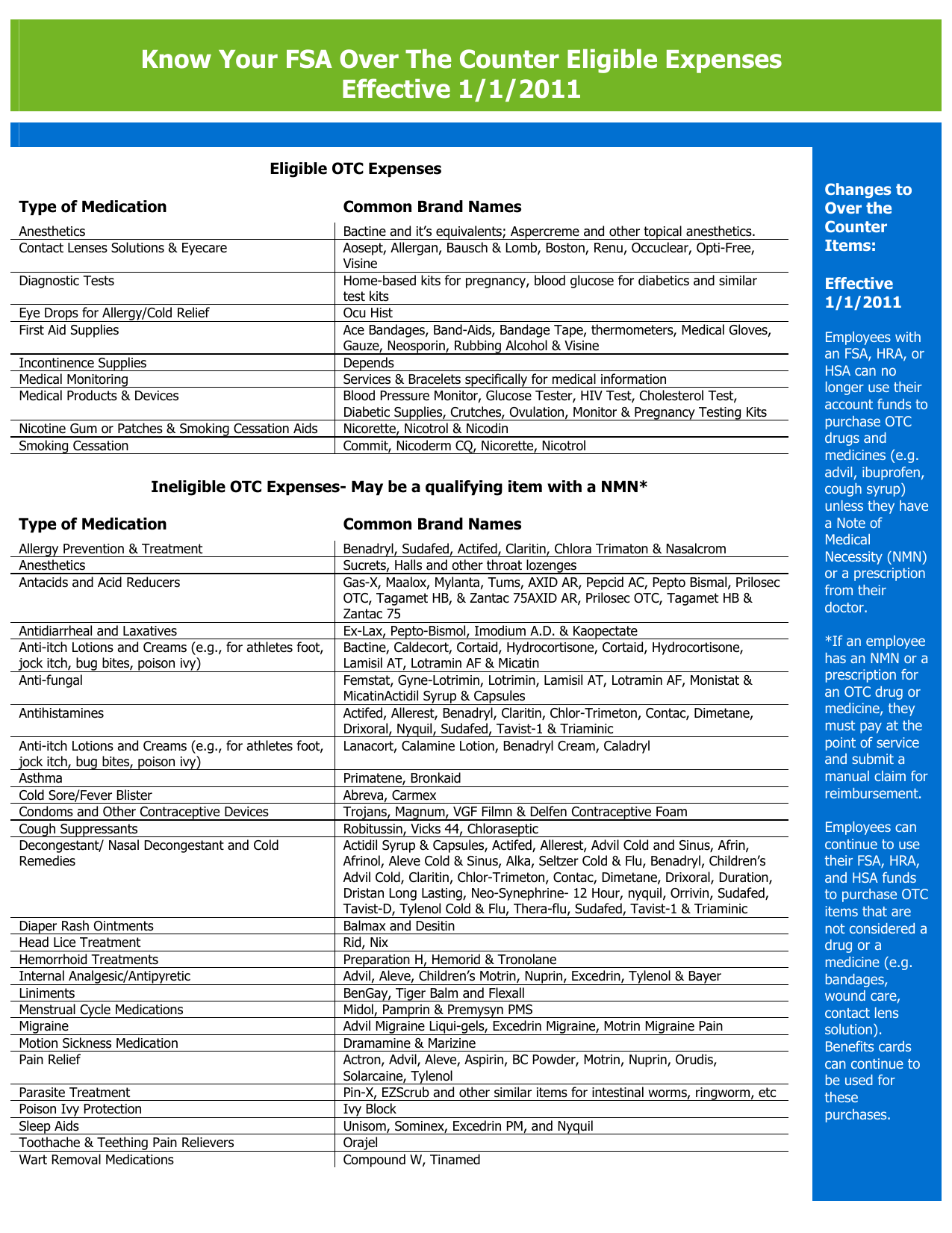

A comprehensive list of eligible and ineligible expenses. 502 should not be used as the sole determinant for whether an expense is reimbursable by a health FSA or HRA or eligible for tax-free distribution from an HSA. 16 rows Various Eligible Expenses.

HRAs are only available to employees who receive health care coverage from an employer. But its important to know which expenses can. You must have a high-deductible health plan HDHP to open an HSA.

A flexible spending account FSA is a spending account for different kinds of eligible expenses. This means youll save an amount equal to the taxes you would have paid on the money you set aside. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

What Are My FSA Eligible Expenses. Get a free demo. A health savings account HSA is an account that you own.

The IRS determines which expenses are eligible for reimbursement. FSAs exist in three different varieties. An FSA is not a savings account.

Dependent Care FSA for Parents. This type of FSA is offered by most employers. However a limited purpose FSA is a little different.

You can use your account to pay for a variety of healthcare products and services for you your spouse and your dependents. Your employer determines which expenses are eligible for reimbursement based on a list of IRS-approved eligible expenses. Certain over-the-counter OTC drugs and medications as well as menstrual care products are now considered qualified medical expenses without the need for a physician prescription.

Health care FSAs are for eligible medical expenses not covered by your health plan. Health Reimbursement Accounts HRAs Health Savings Accounts HSAs and Flexible Spending Accounts FSAs can be great cost-savings tools. This means youll save an amount equal to the taxes you would have paid on the money you set aside.

For FSAs and HRAs you can use your account funds to purchase these products. You dont pay taxes on this money. In order to take a distribution from the dependent care FSA for a parents dependent care expenses the parent must be a tax dependent under IRC 152 as modified by 21 b 1 B who is a physically or mentally incapable of caring for himself or herself and b has the same principal place of abode as.

There are thousands of eligible expenses for tax-free purchase with a Health Savings Account HSA Flexible Spending Account FSA and Health Reimbursement Arrangement HRAincluding prescriptions doctors office copays health insurance deductibles and. You can use a full purpose FSA for any eligible health expenses as listed in your benefit guide. Eligible expenses include health plan co-payments dental work and orthodontia eyeglasses and contact lenses and prescriptions.

An FSA is a tool that may help employees manage their health care budget. However it cant exceed the IRS limit 2750 in 2021. While HRAs are employer funded FSAs can be both employee and employer funded.

List of HSA Health FSA and HRA Eligible Expenses. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars. Medical FSA FSA Dependent Care FSA DCFSA and Limited Purpose FSA LPFSA.

Contributions can be made tax-free for both employers and employees. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs. You dont pay taxes on this money.

You can use these funds to pay for doctor visits medical supplies and other out-of-pocket expenses like vision and dental care. A health savings account HSA is a tax-exempt account set up to offset the cost of healthcare. When you withdraw money from the account you wont have to pay taxes on the funds as long as they cover HSA-eligible.

There are three kinds of FSAs that may be. You can use them to reimburse yourself for eligible health care dental and dependent care expenses. Apply For a CareCredit Credit Card Today.

Ad Finance Out-of-Pocket Healthcare Costs. Although the rules for deductibility overlap in many respects with the rules governing health FSA HRA and HSA reimbursement there are some important differences. You can only use a limited FSA for dental vision and other specified health expenses.

Be Prepared For Whatever Health And Wellness Costs Come Your Way. Elevate your health benefits. Allowed expenses include insurance copayments and deductibles qualified prescription drugs insulin and medical devices.

HRA You can use your HRA to pay for eligible medical dental or vision expenses for yourself or your dependents enrolled in the HRA. The Only One-Stop-Shop Stocked Exclusively With FSA-Eligible Products. Either you or your employer can deposit money into it for future health care expenses.

You can use your Health Care FSA HC FSA funds to pay. You can pay for certain health care vision and dental costs with an HRA HSA or Health Care FSA. You decide how much to put in an FSA up to a limit set by your employer.

As with an HRA money saved in an HSA is not treated as taxable income. Ad Custom benefits solutions for your business needs. There are thousands of eligible expenses for tax-free purchase with a Health Savings Account HSA Flexible Spending Account FSA and Health Reimbursement Arrangement HRAincluding prescriptions doctors office copays health insurance deductibles and.

A health reimbursement account HRA is a fund of money in an account that your employer owns and contributes to. Botox Potentially eligible expense May qualify if recommended to treat a specific medical condition eg migraines. What is FSA HRA eligible.

Easy implementation and comprehensive employee education available 247. Your employer determines which health care expenses are eligible under your HRA. List of HSA Health FSA and HRA Eligible Expenses.

A flexible spending account FSA is a spending account for different kinds of eligible expenses. Employers set the maximum amount that you can contribute. Otherwise will not qualify eg if used for cosmetic purposes.

Common Hsa Eligible Ineligible Expenses Optum Bank

Hra Vs Fsa See The Benefits Of Each Wex Inc

Hsa And Fsa Accounts What You Need To Know Readers Com

Know Your Fsa Over The Counter Eligible Expenses Effective 1 1 Manualzz

Limited Purpose Fsas Combining Hsas And Fsas Infographic

Eligible And Ineligible Fsa Items Flex Administrators Inc

The Perfect Recipe Hra Fsa And Hsa Benefit Options

Eligible Individuals Affiliated Benefits Consultants Inc

Comparing Tax Favored Hsa Hra Fsa Medical Options Don T Mess With Taxes

Understanding The Differences Of Fsa Hsa Hra Accounts Medmattress Com

Fsa Hra Eligible Expenses Mychoice Accounts Businessolver

Fsa Eligible Items Top Tips And What You Can Purchase At A Glance

9 Top Faqs About Hsas Fsas And Hras Benefitspro

Eligible And Ineligible Expenses Cigna Choice Fund

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference